Article on ODI

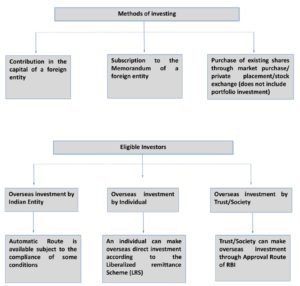

Overseas Direct Investment means investment made outside India by an Indian either under the automatic route or the approval route or by subscription to the memorandum of a foreign entity or by way of contribution to the capital either by the stock exchange or private placement, by setting up Joint Venture (JV) or a Wholly Owned Subsidiary (WOS).

In other words, Overseas Direct Investment in Joint Venture (JV) or Wholly Owned Subsidiary (WOS) is a way of promoting business globally by Indian entrepreneurs. It is a medium of connecting two countries through business co-operation. Overseas Direct Investment is a business strategy in which a domestic firm expands operations toa foreign country.

Employing ODI is a natural progression for firms if their domestic markets become saturated and better business opportunities are available abroad. There are numerous benefits of overseas investments.

Overseas investment involves the transfer of major benefits such as:

- Technology & Skill

- Market Access

- Sharing R&D

- Brand Image

- Employment Generation

- Utilization of Raw Material

It does not only provide benefits to its businesses but also benefits the country as it promotes economic co-operation with the host countries with many other significant benefits. In simplified words, Overseas Direct Investment is an investment made by Indians outside India.

Overseas Direct Investment refers to the investments made in the Joint Ventures (JV) and Wholly Owned Subsidiaries (WOS) by way of:

-Subscription to the Memorandum of a foreign entity; or

-Purchase of existing shares of foreign entity either by market purchase or private placement or through stock exchange

OVERSEAS DIRECT INVESTMENT (ODI) LEGAL FRAMEWORK IN INDIA

ODI is governed by the following in India:

- Section 6(3)(a) of Foreign Exchange Management Act (FEMA) 1999 read with FEM (Permissible Capital Account Transactions) Regulations, 2000

- FEMA (Transfer or Issue of any Foreign Security) Regulations, 2000

- AP (DIR Series) Circulars issued by RBI

- FAQ on Overseas Direct Investment released by RBI (as updated from time to time)

- Liberalized Remittance Scheme of February 4, 2004 amended from time to time

- FAQ on Liberalized Remittance Scheme – Applicable for resident Individuals

ELIGIBLE INDIAN PARTY

An Indian Party is eligible to make Overseas Direct Investment into a Joint Venture (JV) or Wholly Owned Subsidiary (WOS). An Indian Party is:

– a Company

– a body created under an Act of Parliament

– Registered Partnership Firm*

– Limited Liability Partnership (LLP)

– Any other entity in India as notified by RBI

– A combination of the above entities can also form an “Indian Party”.

*Only those Partnership firms which are registered under Partnership act can make outside investment through automatic route. Unregistered Partnership firms require approval of RBI before making any outside investment.

Joint Venture: A foreign entity is termed as JV of the Indian Party when there are other foreign promoters holding the stake along with the Indian Party.

Wholly Owned Subsidiary: In case of WOS entire capital is held by the one or more Indian Parties

Note: ODI in Pakistan is allowed under the approval route. ODI in Nepal can be made in Indian Rupees only.

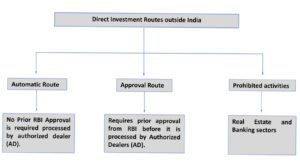

Prohibited activities

Indian Parties are prohibited from making investment or financial commitment in foreign entity engaged in:

– real estate ie meaning buying and selling of real estate or trading in Transferable Development Rights (TDRs) but does not include development of townships, construction of residential/commercial premises, roads or bridges; or

– banking business; or

– offer financial products linked to Indian Rupee e.g. non-deliverable trades involving foreign currency, rupee exchange rates, stock indices linked to Indian market, etc.

CRITERIA FOR ODI UNDER AUTOMATIC ROUTE

An Indian Party can make outside investment through automatic route subject to the compliance of following conditions:

– The total financial commitment (“FC”) of Indian Party in overseas JV/ WOS shall not exceed 400% of its net worth* (as per the last audited Balance Sheet).

– FC made out of balances held in the EEFC account of the Indian party or out of funds raised through ADRs/GDRs will not be taken into consideration for the purpose of the aforesaid calculation.

– Prior approval of RBI is required if the FC exceeds USD 1 Billion in a Financial Year.

– Overseas JV/ WOS shall carry out bonafide activity permitted as per the law of the host country.

– Indian Party shall not be on the RBI’s exporters’ caution list / list of defaulters/ under investigation by enforcement agency.

– All transactions relating to a JV / WOS routed through one branch of an AD bank. For switching over to another AD, an application shall be made to RBI after obtaining an NOC from the existing AD.

In case of acquisition of an existing foreign company and the investment is more than USD 5 million:

- valuation of the shares of the company shall be made by a Category I Merchant Banker registered with SEBI or an Investment Banker / Merchant Banker outside India registered with the appropriate regulatory authority in the host country.

- In all other cases by a Chartered Accountant or a Certified Public Accountant.

*Net Worth means paid up capital and free reserves however free reserves not defined in ODI Regulation. Companies Act 2013 -Section 2(43) –Free reserves does not include Securities premium which is included in Net Worth definition under section 2(57).

SOURCE OF FUNDING

Funding for overseas direct investment can be made by one or more of the following sources:

– Drawl of Foreign Exchange/p>

– Capitalization of exports and other dues and entitlements

– In exchange of ADRs (American Depository Receipt) / GDRs (Global Depository Receipt) issued*

– Market Purchase

– Swap of Shares **

– Proceeds of External Commercial Borrowings (ECBs) / Foreign Currency Convertible Bonds (FCCBs)

– Proceeds of foreign currency funds raised through ADR / GDR issue

– Balances held in EEFC Account

Capitalization of export proceeds remaining unrealized beyond the prescribed period of realization will require the prior approval of RBI.

For any capitalization of exports, alongwith Form ODI, a custom certified copy of the invoice raised towards the export must be submitted to RBI.

Indian software exporters are permitted to receive 25% of the value of their exports to an overseas software start-up company in the form of shares without entering into Joint venture Agreements, with the prior approval of the Reserve Bank.

*American Depository Receipt (ADR) means a security issued by a bank or a depository in United States of America (USA) against underlying rupee shares of a company incorporated in India.

Global Depository Receipt (GDR) means a security issued by a bank or a depository outside India against underlying rupee shares of a company incorporated in India;

** In cases of swap of shares, valuation of the shares shall be made by a Category I Merchant Banker registered with SEBI or an Investment Banker outside India registered with the appropriate regulatory authority in the host country. Approval of FIPB is also required.

FINANCIAL COMMITMENT

Financial Commitment means the amount of direct investment by way of contribution to equity, loan, guarantees, performance guarantees issued by an Indian Party to or on behalf of its overseas JV or WOS. the financial Commitment comprises of:

- 100% of the amount of equity shares and/ or Compulsorily Convertible Preference Shares (CCPS);

- 100% of the amount of other preference shares;

- 100% o f the amount of corporate guarantee;

- 100% of the amount of bank guarantee issued by a resident bank, provided that the bank guarantee is backed by a counter guarantee / collateral by the Indian Party.

- 50% of the amount of performance guarantee.

provided that if the outflow on account of invocation of performance guarantee results in the breach of the limit of the financial commitment in force, prior permission of the Reserve Bank is to be obtained before executing remittance beyond the limit prescribed for the financial commitment.

Conditions

– Indian Party can extend Loan and guarantee to an overseas entity only if there is already an existing equity/CCPS participation by way of direct investment.

– However, with the RBI’s approval the Indian Party may undertake such financial commitment without equity contribution in JV/WOS based on the business and legal requirements of the host country.

– All the FCs, including all forms of guarantees and creation of charge are within the overall ceiling prescribed for the Indian Party.

– The amount and period of the guarantee should be specified upfront. In the case of performance guarantee, time specified for the completion of the contract shall be the validity period of the related performance guarantee.

In cases where invocation of the performance guarantee breaches the ceiling for the financial commitment, the Indian Party shall seek the prior approval of the Reserve Bank before remitting funds from India, on account of such invocation.

REPORTING REQUIREMENTS

In respect of Initial Investment:

An Indian Party shall submit Part I of the Form ODI within 30 days of Investment with designated Branch of Authorized Dealer Bank along with the following annexures:

- Certified Copy of Board Resolution approving the Investment Outside India

- Remittances Proofs i.e. Bank Documents of payments

- Statutory Auditor’s Certificate

- Form A2 (Form A2 is submitted to Banks at the time of remittance Outside India)

- Valuation report for the value of shares

After receiving the aforesaid documents, AD Bank shall verify all the Documents and if found in order, forwards the same to RBI.

RBI then allots a Unique Identification Number (UIN) for that particular JV/WOS.

UIN No. is allotted by RBI to Indian Party in respect of each JV/WOS outside India.

In respect of Subsequent Investment:

An Indian Party shall quote the UIN No. as allotted by RBI in Part I of form ODI.

Contents of Part I of the form ODI:- All ODI forms are submitted to the AD Bank in physical. Part I of form is divided in sections which includes the following:

- Section A – Details of the Indian Party (IP)/Resident Individual (RI)

- Section B – Capital Structure and other details of JV/WOS/Step Down Subsidiary

- Section C – Details of Transaction/Remittance/Financial Commitment of IP/RI

- Section D – Declaration by the IP/RI

- Section E – Certificate by the statutory auditors of the IP/self certification by RI

POST INVESTMENT OBLIGATIONS OF INDIAN PARTY

Event Wise

- Receive Share Certificates/Other Documentary Evidence: An Indian Party shall receive share certificates/ any other documentary evidence of investment in the overseas JV / WOS and submit the same to the designated AD within 6 months.

- Repatriation of Dues: Repatriate to India all dues receivable from the overseas JV / WOS, like dividend, royalty, technical fees etc within 60 days of its falling due, or such further period as the Reserve Bank may permit.

- Repatriation of Sale Proceeds in case of Disinvestment: On disinvestment, repatriate the sale proceeds immediately or not later than 90 days from the date of sale of the shares /securities.

Recurring

- Submission of Annual Performance Report (APR): Submission of APR in Part II of Form ODI in respect of each JV/WOS outside India set up or acquired by the Indian party by 31 December every year.

- Submission of Return on Foreign Liabilities and Assets: File Foreign Liabilities and Assets (FLA) return every year by 15 July.

Transfer/Sale of shares without write off of the investment

An Indian Party, under the automatic route, may transfer by way of sale to another Indian Party or to a person resident outside India, any share or security held by it in a JV or WOS outside India subject to the following conditions:

– the sale does not result in any write off of the investment or financial commitment made;

– the sale is effected through a stock exchange where the shares of the overseas JV/ WOS are listed;

– if the shares are not listed and the shares are disinvested by a private arrangement, the share price is not less than the value certified by a Chartered Accountant / Certified Public Accountant on the latest audited financial statements of the JV / WOS;

– the Indian Party does not have any outstanding dues from the JV or WOS;

– the overseas concern has been in operation for at least one full year and the reporting in APR has been submitted alongwith audited accounts for that year with RB;

– the Indian Party is not under investigation by CBI / DoE/ SEBI / IRDA or any other regulatory authority in India;

– The Indian Party shall intimate to RBI through AD Bank of such disinvestment within 30 days from the date of disinvestment.

Transfer/sale of shares involving write off of the investment

Indian Party may disinvest with write off under the automatic route where the amount repatriated after disinvestment is less than the original amount invested subject to the following:

- where the JV / WOS is listed in the overseas stock exchange;

- where the Indian Party is listed on a stock exchange in India and has a net worth of not less than Rs.100 crore;

- where the Indian Party is an unlisted company and the investment in the overseas JV / WOS does not exceed USD 10 million; and

- where the Indian Party is a listed company with net worth of less than 100 crore but investment in an overseas JV/WOS does not exceed USD 10 million.

All other conditions as applicable in disinvestment without write off shall mutatis mutandis apply for Disinvestment with write off.

Prior approval is required from RBI, if does not satisfy the conditions laid down above for undertaking any disinvestment in its JV/WOS abroad.

Restructuring of the balance sheet of the overseas entity Writing off Capital or Other Receivables:

- Listed Indian companies are permitted to write off capital and other receivables up to 25% of the equity investment in the JV /WOS under the Automatic Route; and

- Unlisted companies are permitted to write off capital and other receivables up to 25% of the equity investment in the JV /WOS with prior approval of the Reserve Bank.

Compliances followed by the Indian Party:

- Reporting of Part III of Form ODI to AD Bank within 30 days of divestment;

- On disinvestment, repatriate the sale proceeds immediately or not later than 90 days from the date of sale of the shares /securities;

- A certified copy of the balance sheet showing the loss in the overseas WOS/JV set up by the Indian Party; and

- Projections for the next five years indicating benefit accruing to the Indian company consequent to such write off / restructuring.

OVERSEAS DIRECT INVESTMENTS BY RESIDENT INDIVIDUALS

A resident individual (single or in association with another resident individual or with an Indian Party), may make overseas direct investment in the equity shares and compulsorily convertible preference shares of a Joint Venture (JV) or Wholly Owned Subsidiary (WOS) outside India.

- Investment in overseas JV / WOS only by way of equity / compulsorily convertible preference shares.

- JV / WOS to be engaged in bonafide business activities except real estate / banking / financial services.

- Resident individual not to be on RBI caution / defaulters list.

- Limit of investment in JV / WOS as per LRS limit (currently USD 250,000 per person per annum).

- Investment made from EEFC / RFC account also included in prescribed LRS limit.

- Undertaking financial commitment on behalf of the JV or WOS other than ODI (subscription to equity/ CCPS) is prohibited.

- JV / WOS to be operating entity only – No step down subsidiary to be acquired or set up by JV / WOS.

- Write off not permitted in cases of disinvestments.

Valuation /Reporting and Post investment obligations same as applicable to ODI by Indian Party.

PURCHASE/ ACQUISITION OF FOREIGN SECURITIES IN CERTAIN CASES

– General permission has been granted to a person resident in India who is an individual

– to acquire foreign securities as a gift from any person resident outside India;

– to acquire shares under cashless Employees Stock Option Programme (ESOP) issued by a company outside India, provided it does not involve any remittance from India;

– to acquire shares by way of inheritance from a person whether resident in or outside India;

– to purchase equity shares offered by a foreign company under its ESOP Schemes. AD banks are permitted to allow remittances for purchase of shares by eligible persons under this provision irrespective of the method of operationalisation of the scheme.

Resident Indian may transfer by way of sale the shares acquired as stated above provided that the proceeds thereof are repatriated immediately on receipt thereof and in any case not later than 90 days from the date of sale of such securities.

In all other cases, approval of the Reserve Bank is required to be obtained before acquisition of a foreign security.

OVERSEAS DIRECT INVESTMENT BY REGISTERED TRUST AND SOCIETIES

Registered Trusts and Societies engaged in manufacturing/educational/hospital sector are allowed to make investment in the same sector(s) in a JV/WOS outside India, with the prior approval of the Reserve Bank.

Eligibility Criteria for Trust

- The Trust should be registered under the Indian Trust Act, 1882;

- The Trust deed permits the proposed investment overseas;

- The proposed investment should be approved by the trustees;

- The AD Category – I bank is satisfied that the Trust is KYC (Know Your Customer) compliant and is engaged in a bonafide activity;

- The Trust has been in existence at least for a period of three years;

- The Trust has not come under the adverse notice of any Regulatory/Enforcement agency like the Directorate of Enforcement, Central Bureau of Investigation (CBI), etc.

Eligibility Criteria for Society

- The Society should be registered under the Societies Registration Act, 1860.

- The Memorandum of Association and rules and regulations permit the Society to make the proposed investment which should also be approved by the governing body/council or a managing/ executive committee.

- The AD Category – I bank is satisfied that the Society is KYC (Know Your Customer) compliant and is engaged in a bonafide activity;

- The Society has been in existence at least for a period of three years;

- The Society has not come under the adverse notice of any Regulatory /Enforcement agency like the Directorate of Enforcement, CBI etc.

Valuation /Reporting and Post investment obligations are same as applicable to ODI by Indian Party.